Dawn Foods Implements New Supply Chain Processes to Respond to Covid

Companies have been whiplashed by the combination of a long running pandemic and the recession it kicked off. Better planning can help companies mitigate the effects of this crisis. Sandy Evett, the vice president of distribution and supply chain at Dawn Foods, gave a presentation on how her company has responded. Ms. Evett gave the speech at the Association for Supply Chain Management (ASCM) Connect 2020 online forum at the end of September.

Dawn Foods is an international manufacturer and distributor of the bakery ingredients headquartered in Jackson, Michigan. In North America, which was the focus of this presentation, the company has five manufacturing plants and 20 distribution centers in North America. They ship to customers either directly from their factory or their distribution centers. They ship their products to companies in the artisanal, food service, manufacturing, and supermarket channels. “Our promise,” Ms. Evett stated, “is to help our customers grow their business – to help make them be the baker of choice in their community.”

When 2020 started off, Dawn Foods business got off to a great start. Then Covid hit. Dawn Foods – like many manufacturers – then experienced complex, variable, and hard to forecast demand. This article is focused on how this manufacturer got a better handle on their demand, how they balanced the demand with their manufacturing capacity, and how they managed inventory and employee costs.

There were different product, regional, and channel impacts. During the early days of the pandemic consumers were stocking up on sugar, shortening and flour as end consumers sought to bake or buy comfort foods like bread. From a regional perspective, at the same time Georgia, Florida, and Texas were opening, and demand nearly meant targets, other regions were lagging behind preCovid demand projections by 40-50%. From a channel perspective, food service saw big drops in orders, while the supermarket channel saw significant increases in sales.

In this kind unprecedented situation, companies can’t rely on their demand planning algorithms to accurately forecast demand in the coming weeks. “We could not predict how far demand would drop before we would hit the bottom,” Ms. Evett explained. The company moved from using six weeks of historical demand for their statistical forecast, to generating forecasts based on the last two weeks of demand.

On top of the statistical forecast, the company now layers on a rigorous process for key account forecasting. With the key accounts, there is detailed discussion and review on about 50 percent of the stock keeping units (SKUs) that an account purchases. A stock keeping unit is a product/packaging combination. A one-pound bag of a specific type of flour would be one SKU, the same flour in a five-pound bad would be a different SKU.

This collaboration between forecasters and account managers occurred weekly. During the pandemic, as regions closed, accounts would stop buying. When the regions opened, the accounts would begin buying again. Forecasters then needed to make some assumptions about how fast traffic would come back into these stores and thus how much and how quickly demand would bounce back.

In Dawn Foods sales & operations planning (S&OP) process, the demand team passes their forecast for the next month to the supply planning team. At most companies that production and factory shipping plan is not written in stone, but it is mostly locked down. Dawn Foods needed to make adjustments to this plan much more frequently using much more granular data. “During the depth of the crisis – in April and May – we relied on daily snap shots of inventory and production to make the right choices for what to produce in the plants,” Ms. Evett explained. The team also looked at what they were producing – their product portfolio includes 10,000 different stock keeping units. “Detailed analytics were critical.” This exercise helped them control costs by better forecasting what labor would be needed in their warehouses and factories.

Another new process, that began in April, involved an analysis of how the SKU demand pattern by distribution center was changing. This analysis was conducted at the product family level. This also required more cross functional collaboration.

There are also costs associated with carrying inventory. But in a situation where forecasting becomes less accurate, achieving customer service targets becomes more difficult. Dawn Foods made the decision to provide consistent service to customers by “carrying incremental days on hand inventory above and beyond what demand forecasting indicated.”

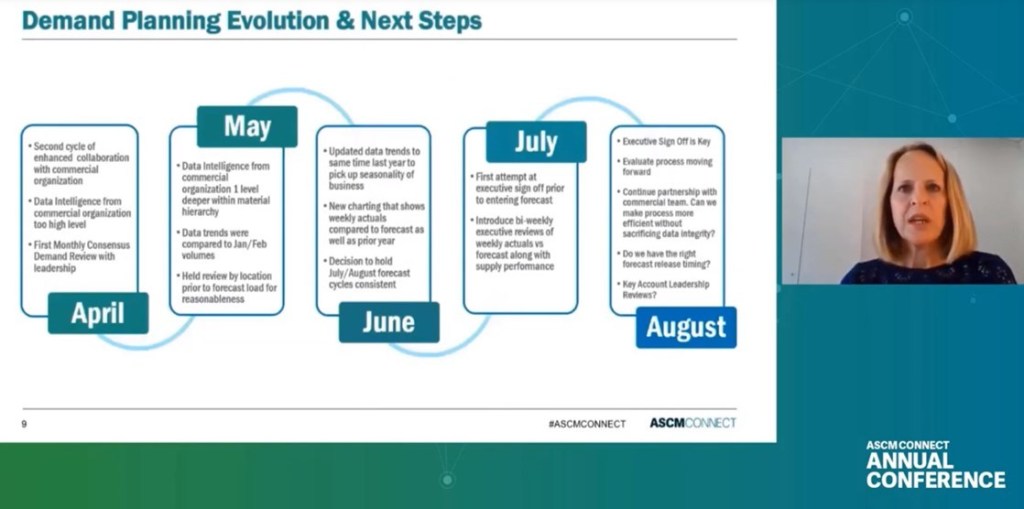

Dawn Foods has had rapid changes in their S&OP process. There is participation from a wider variety of team members across different disciplines. There is also a new, formal sign off on the forecast by the market sales directors before the demand plan is released to the supply planners. Finally, the formal forecast review now involves the full participation of the North American leadership team. Ms. Evett explained that “this level of participation has been critical” for controlling costs while maintaining customer service.

Many of these changes would have “required months, if not years” to fully implement in the past. During the pandemic the company used the agile project methodology to fast track these changes. Agile involves continuously making smaller changes, more often, getting feedback, and then quickly making adjustments based on the feedback.

Ms. Evett concluded by saving that responding effectively has been a lot “like surfing” the storm waves caused by the pandemic. The result has been much more robust supply chain planning processes.

Recent Comments