Advertisement

Bets running from coolers and campers to cloud computing helped three mutual funds trounce the S&P 500 in the second quarter.

By Tim Gray

Returns on some types of mutual funds have been so lofty they look like typos.

Small-capitalization growth funds rose an average of nearly 54 percent in the second quarter, for example, making up for big losses in the market downturn of February and March.

Here is how three of the top funds from several of the better-performing sectors of the market managed to get eye-popping returns in the three months through June.

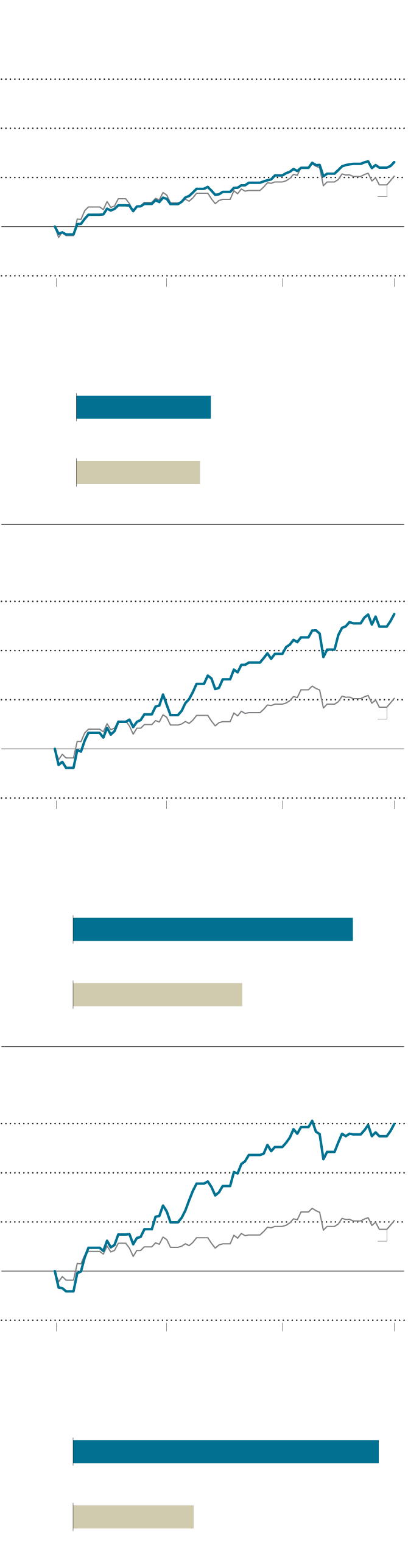

AllianzGI Convertible Fund

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

AllianzGI Convertible Fund

+26.3%

Convertibles

+24.2%

Driehaus Microcap Growth

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

Driehaus Microcap Growth

+54.8%

Small-cap growth

+33.1%

Aperture Discover Equity

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

Aperture Discover Equity

+59.9%

Small-cap blend

+23.6%

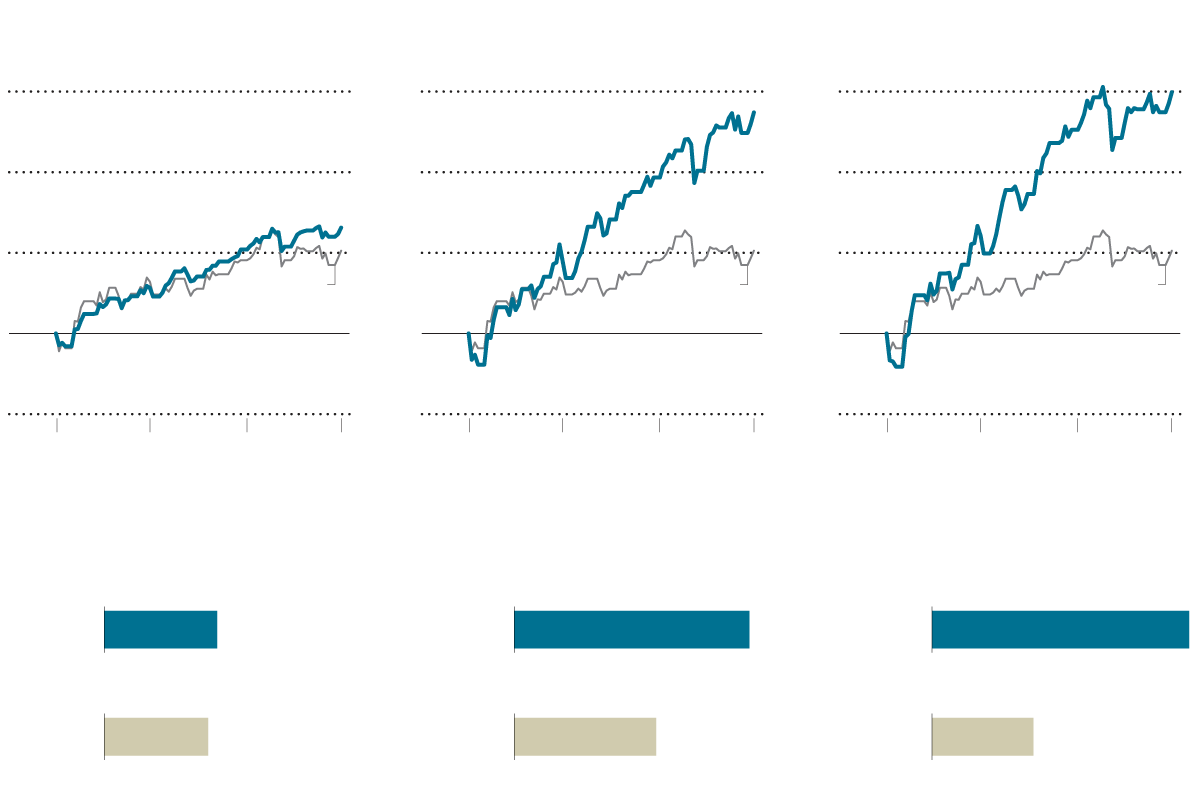

AllianzGI Convertible Fund

Driehaus Microcap Growth

Aperture Discover Equity

S. & P. 500

TOTAL RET.

S. & P. 500

TOTAL RET.

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

AllianzGI Convertible Fund

Driehaus Microcap Growth

Aperture Discover Equity

+26.3%

+54.8%

+59.9%

Convertibles

Small-cap growth

Small-cap blend

+24.2%

+33.1%

+23.6%

AllianzGI Convertible Fund

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

AllianzGI Convertible Fund

+26.3%

Convertibles

+24.2%

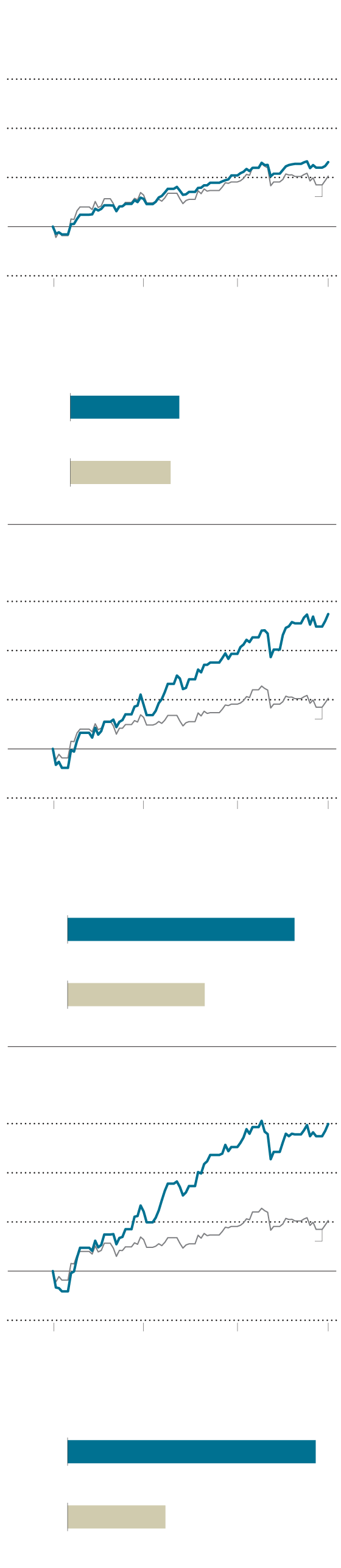

Driehaus Microcap Growth

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

Driehaus Microcap Growth

+54.8%

Small-cap growth

+33.1%

Aperture Discover Equity

S. & P. 500

TOTAL RET.

SECOND-QUARTER RETURNS

Aperture Discover Equity

+59.9%

Small-cap blend

+23.6%

Brad D. McGill, manager of the Aperture Discover Equity Fund, runs one of those small-cap growth funds. The returns were remarkable: 59.9 percent in the second quarter.

Mr. McGill not only buys small-cap stocks — among the stock market’s jumpiest fare — but he also concentrates his fund’s portfolio, holding only 23 stocks. That dual approach can amplify ups and downs.

“There will be volatility along the way, but we’re thinking over the longer term,” he said. The fund opened in December, but Mr. McGill said he’s aiming to hold investments for two to four years.

Lately, consumer-oriented companies have done well for him, especially those benefiting from lifestyle changes forced by the coronavirus pandemic, Mr. McGill said.

Take Yeti, a maker of expensive coolers and drink ware. It was a sought-after brand among outdoor enthusiasts before the virus arrived, he said. Now, with concerns about crowds, people are spending more time in the wild. That should benefit Yeti, he said.

In addition, the company has a trait Mr. McGill said he seeks in any holding — a strong digital operation. “They have a really good website, selling direct to consumers, and a significant Amazon presence.”

Another of his stocks that aims to exploit the embrace of the outdoors is Malibu Boats. Malibu makes powerboats, particularly ones that tow water-skiers and their cousins, wakeboarders.

“Wakeboarding is a faster-growing area in boating in general,” Mr. McGill said. A small boat, like a car, lends itself to social distancing.

An unusual feature of Mr. McGill’s fund is how it charges its investors. Instead of imposing a flat fee of, say, 1 percent of assets, the fund levies a performance-based one, called a fulcrum fee.

If Mr. McGill equals or underperforms his benchmark, the Russell 2000 Total Return Index, Aperture will charge 0.42 percent. But the more he beats the benchmark, the more the fee rises, going as high as 4.17 percent when the fund’s performance exceeds the index by 12.5 percent or more. On June 30, the fee was 4.17 percent.

Like Mr. McGill, Jeff P. James, lead portfolio manager of the Driehaus Microcap Growth Fund, seeks the investing equivalent of spawn that can morph into king salmon. He, too, looks for outstanding specimens among the market’s small fry.

Integral to his approach is the identification of earnings surprises and revisions — that is, times when a company’s earnings beat analysts’ forecasts or when analysts change those forecasts.

“We look at all the surprises and revisions and see why they’re happening,” Mr. James said. An underlying driver that signals future growth, like a company gaining market share or increasing comparable-store sales, can point to a promising investment.

Mr. James has also recently found winners among consumer stocks. The economy has slowed because of the pandemic, yet some consumers are still spending.

Some of those consumers seem to be headed to the woods — or at least gearing up to do so. Two of Mr. James’s better-performing stocks in the second quarter were Winnebago Industries, a maker of recreational vehicles, and Camping World Holdings, a seller of R. V.s and services for R.V. owners.

Instead of going to a ballgame or an amusement park, he said, many people are going camping.

Winnebago shot up in the second quarter, returning 140 percent. “Their results and revisions have been quite strong — they’ve been taking market share,” he said.

The stock’s recent rise is a shift. Mr. James said it had moved “sideways” for much of the last two decades and had been hampered by oversupply in its industry.

Its acquisition of a competitor, Grand Design R.V., and the arrival of a relatively new chief executive, Michael J. Happe, both in 2016, have helped improve its fortunes, Mr. James said.

In the second quarter, the Driehaus fund, which carries an expense ratio of 1.48 percent, returned 54.8 percent, compared with 20.54 percent for the S&P 500, including dividends.

Justin M. Kass and Doug G. Forsyth, managers of the AllianzGI Convertible Fund, invest in securities that many investors don’t entirely understand.

These are convertible securities — bonds or preferred stocks that can be swapped for a set amount of the issuing company’s common stock, if the common stock hits an agreed-upon price level.

Convertibles therefore have features of both bonds and stocks. Mr. Kass likened them to stocks with shock absorbers, with the bond payment providing a cushion when the stock market is hazardous.

He said many recent issuers of convertibles have been technology or health care companies with good growth prospects.

That suits his and Mr. Forsyth’s investment style. They seek outfits that can “meet or exceed earnings estimates and the market’s expectations, and a lot of those are in tech and health care,” he said.

Bets in those two industries account for just over 60 percent of the fund’s assets.

Among the tech holdings is DocuSign, a cloud computing company that specializes in electronic signatures.

DocuSign benefited from the migration to cloud-based computing before the coronavirus arrived, Mr. Kass said. Then it enjoyed a boost in the first quarter as many people were forced to work from home.

ON Semiconductor, a computer chip-maker with a substantial automotive and industrial sales, also did well for the fund.

Mr. Kass said ON Semiconductor was “overly punished” by the market’s first-quarter sag but snapped back in the second quarter. That was partly because “auto sales are coming in better than expected,” he said.

The AllianzGI fund, whose A shares have a net expense ratio of 0.96 percent, returned 26.3 percent in the second quarter.

Recent Comments