This article was selected to be shared with PRO+ subscribers – find out more here.

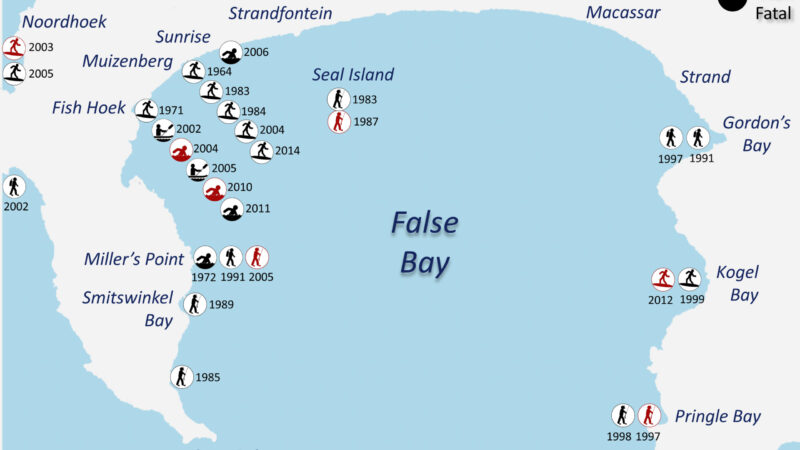

I have the privilege of living on the island of Oahu, Hawaii. I take my family to the beach at least once a week, and we love to hear, watch, and play in the waves. The satisfaction notwithstanding, caution is always advised. “Never turn your back on the ocean”, the saying often goes, and for good reason. Waves not only have power coming into land but also going back out to sea. They can exert a tremendous pull that will overpower even the strongest of swimmers, and next thing you know, you are a long way from shore. Even those that brace themselves against oncoming waves can be knocked off their feet and caught unawares as the water rushes back. Waves that come rushing in always recede. It’s the natural order of things.

Source:

I feel that the thing missing from most discussions about the wave of aging baby boomers is the fact that eventually, it will recede. No one escapes death. Therefore, any investment thesis that is rooted in “there are going to be lots of old people” is fragile at best because it will force people to try and appropriately time the wave, if there is one, and get out before it crests and breaks as the baby boomers start dying off in ever larger numbers.

You are probably accustomed to hearing things like:

“10,000 baby boomers reach retirement age EVERY DAY”.

“The number of people 65+ will triple by the end of 2029”.

The argument goes that all these old people will need places to live and places to get health care so invest in everything that has anything to do with taking care of the elderly. Healthcare REITs have received especial attention in this regard. I was just starting out as an investor when I first heard all these things and it dazzled me. It was a no brainer, so I thought, and I bought the stock of several REITs that I knew little about. I have since learned that few things are as good as people say they will be, nor as bad as people fear. In other words, things are nuanced.

Here are a few things you probably aren’t used to hearing:

The number of baby boomers alive at 78.8 million.

, 59% of baby boomers who had kids were still providing financial support to those children between the ages of 18 and 39.

78% of baby boomers have some debt.

already are or anticipate staying employed past age 65 or don’t plan on retiring at all.

, 52% of baby boomers said they do not plan on moving out of their homes.

Travel was ranked as the #1 priority in retirement

See what I mean? There is so much more going on than “there are going to be lots of old people!!” We have to ask questions such as:

– How long are the baby boomers going to live?

– How fast will the baby boomer generation die off?

– How healthy are the baby boomers?

– Will they be able to afford to move to a retirement center?

– Do they even want to move to a retirement center?

– How much money do the baby boomers have, and how do they want to spend it?

– What is the likelihood of the baby boomers simply aging in place with dependents to take care of them?

– At what age do people typically move to a retirement home?

– How much does it cost to stay in a retirement home, and in which direction are those costs trending?

– How long, on average, do people stay in elderly facilities before dying?

My intent today is to answer some of these questions and others, and particularly the impact that healthcare operators will feel as represented by the top holdings in the Janus Long Term Care ETF (OLD). This ETF represents a good cross-section of impacted areas, with Welltower (WELL), Ventas (VTR), HCP (HCP), Omega Healthcare (OHI), and Sabra (SBRA) representing the top 5 holdings, over 50% of the portfolio. Bottom line up front: my prediction is that due to the many factors involved, the impact of this wave will be mild on healthcare operators for the next decade or so. But there will come an inflection point where the wave starts to recede, and those operators will be left with some empty beds and nothing to do with them. Read on as we explore the many angles of this topic.

Source:

Types of Care

There are different types of retirement care that the elderly have available to them. Each of these types will be impacted very differently by the unique dynamics at play as the baby boomers age. They are:

Independent Living: As implied by the name, this level of care is for healthy seniors who still take care of themselves. Basically, independent living facilities are apartment complexes that have an age requirement, with added amenities. The price differences and amenities vary widely. Amenities can include meals, housekeeping, social and recreational activities, and transportation.

Assisted Living: This is for elderly folk who need some help with everyday tasks like bathing, housekeeping, health monitoring, and the like. They are generally healthy people, but some light medical care is provided. Medicare and Medicaid typically do not cover assisted living. Assisted living is sometimes referred to as simple custodial care, like making sure people take their meds.

Skilled Nursing: This represents the highest level of care, as patients are giving round the clock attention from licensed nurses and doctors. Can be short or long-term in duration.

It is important to keep in mind that many healthcare operators deliberately diversify into these three areas and others, while some are more pure play into one. So, how will each be impacted?

Independent Living

In my opinion, independent living facilities, and those REITs whose portfolios are concentrated heavily here, will fare the worst in the next few decades. The reasons are many:

1) Medicare and Medicaid do not pay for independent living. Each resident will be required to foot the entire bill, though social security benefits can, of course, be used.

2) Many seniors will not be able to afford an independent living facility. You may be surprised to learn, as I was, from some findings of various research reports on retirement savings. One study concluded that . According to another research study, from the , 45% of baby boomers have no retirement savings whatsoever and, of the 55% leftover, 28% reported having less than $100,000. An interesting explains:

The. U.S. Census Bureau reports two different measures of poverty: the official poverty measure and the (SPM). In 2017, the under the official measure was $11,756 for an individual age 65 or older. Unlike the official measure, the SPM poverty thresholds vary by geographic area and homeownership status, and the SPM reflects financial resources and liabilities, including taxes, the value of in-kind benefits (e.g., food stamps), and out-of-pocket medical spending.

Under the official poverty measure, 4.7 million adults ages 65 and older lived in poverty in 2017 (9.2%), but that number increases to 7.2 million (14.1%) based on the Supplemental Poverty Measure.

When you check out the price tag for many independent living facilities, you wonder if someone with a regular paycheck would even be able to afford it. According to , a significant component of both Ventas and Welltower portfolios, rent starts at $1,000 a month and can go as high as $10,000, with an average being $2,900. For context, in New York is $2,750. in 2019 were only $1,422. Putting all this information together, for many seniors moving to independent living wouldn’t make sense or would be a financial impossibility.

3) Even if they have the money, many seniors don’t even want to move into a retirement community. In the past, as people reached their golden years they would sell the home they raised their family in and then downsize into a retirement facility. The proceeds from the sold home would go a long way towards paying rent and other living expenses. But that trend is going away. brings up several impactful points:

– An Ipsos poll in 2017 found that 43% of 45-65-year-olds planned on staying in their current homes through retirement. Earlier this year, a Chase bank survey showed that number rising to 52%. This suggests that the number of people planning to age in place is growing.

– Moving into a retirement home has negative connotations. Remaining in one’s home as long as possible elongates the feeling of being in the prime of one’s life.

– Among those who do plan to move out of their long-time home, 43% want to move into a place that was as large as their old home, and 22% want an even bigger home. Large living spaces are absent in retirement communities that typically feature small quarters in a multi-family building. Nearly half of seniors who have expressed an interest in moving have no intention of going to a retirement home.

– Retirees are resistant to the idea of having to make house or rent payments again. With mortgages paid off, why move?

These points simply make sense. If you break it down into pros and cons, it logically follows that moving into an independent living facility isn’t attractive. To downsize into a retirement community you would have to leave behind neighbors and a community you are familiar with, sell many of your belongings that won’t fit into less square footage, have less space with which to host visiting kids and grandkids and resume sizeable monthly rent payments. This is to say nothing of the intangible import of leaving behind the home that so many memories were made in.

4) People enter independent living facilities much later in life than you might expect. Dr. Margaret Wylde, CEO of , a global market research and advisory firm and has done much work in the senior housing realm, says that people who enter independent living facilities do so around age 84. says that seniors make the move between 75 and 84 years of age. This is significant. People aren’t moving into independent living facilities right when they retire. Delaying the move by more than a decade after retiring means that they will have drawn down their retirement savings considerably and simply can’t afford independent living. It also increases the probability of death before even considering moving. Furthermore, entering at a later age means that they will inhabit those facilities for a much shorter time before they die or have to enter into an assisted living facility or skilled nursing center. See what I mean by nuance?

If we take the midpoint of the baby boomer era, those born between 1946 and 1964, that puts those born in 1955 at 64 years old today. If the trend continues, that means that we still have to wait another 11-20 years before the majority of this cohort will be looking for independent living centers. Don’t get me wrong, I absolutely invest for the long term. But SO MUCH can happen in 11-20 years that investing now banking on that supposed windfall is haphazard.

In context of all this, looking at occupancy rates for the main players in the independent living space can be informative. Following is a table that shows quarterly occupancy rates for Welltower the largest senior housing owner. The numbers represent weighted averages between the RIDEA and NNN portfolios (more on the difference between RIDEA and NNN follows). Adjacent to the ticker in parenthesis is how much of their current NOI comes from independent living as of last quarter:

| occupancy % |

Q2 19′ |

Q1 19′ |

2018 |

’17 |

’16 |

’15 |

’14 |

’13 |

’12 |

’11 |

| WELL (69.7%) | 87.08 | 87.23 | 87.02 | 86.33 | 88.03 | 89.91 | 89.29 | 89.2 | 91.1 | 89.1 |

*Data Compiled by author

(Note: for WELL year ’13, ’12, and ’11, simple averages were taken between the RIDEA and NNN portfolio since data wasn’t available for the weighted average calculation)

Interestingly, since 2011 when the first baby boomers started hitting retirement and through a period where 10,000 more were reaching retirement daily, occupancy has gone down. Not up. Certainly the opposite of what you might expect. Now, it is certainly possible that WELL is simply expanding capacity to prepare for a future wave, and that growth has outpaced their ability to fill the rooms. But nonetheless, these figures give me pause. How is WELL supposed to know when to stop buying so as to not overbuy and end up in a perpetual state of low occupancy? Furthermore and with an ultra long range point of view, what do they do with all these properties once the total senior population starts to decline?

The other vital matter to be aware of is the difference between RIDEA and NNN. Under NNN, the property owner simply collects a check. Even if the operator is really struggling with occupancy or rents, as long as they can cut the rent check, it’s okay. It is safer. With RIDEA, the owner also acts as operator and, therefore, is exposed to every fluctuation in occupancy or rental rates. For better or for worse. For A LOT more detail on RIDEA vs. NNN and the tremendous implications, read this article. If this demographic wave doesn’t take shape in the way or at the time these REITs are considering, they are going to take it right in the teeth. The biggest players in the RIDEA space are New Senior (SNR), Welltower, and Ventas, each with 62%, 43%, and 30% of their NOI from RIDEA, respectively.

Assisted Living

Much of what was said about independent living applies to assisted living. The biggest difference is that some seniors may find themselves more or less forced into an assisted living center if they can’t take care of themselves and they don’t have family or friends to rely on. This semi-obligatory nature favors this segment slightly better in my opinion. This is also verified by data. Here is a graph showing inventory growth and absorption rates (the rate at which new rooms are occupied) for independent living and assisted living:

*Graph from

In spite of much faster growth in units, assisted living units are being taken up at a much faster rate than the independent living counterparts. Again, assisted living is semi-obligatory, which favors the profile.

Skilled Nursing

Skilled nursing centers are higher up on the spectrum of care. They are necessity-based, requiring care from licensed professionals. Due to the dynamics involved, Medicare and Medicaid often cover a portion of the expenses incurred with a skilled nursing stay. Because of more stringent staffing requirements, skilled nursing centers are much more expensive than independent or assisted living, but costs vary wildly from state to state and facility to facility. These factors are both pros and cons for skilled nursing. The obligatory nature of admittance is certainly a plus. People have less discretion as to whether or not they end up in a skilled nursing facility. r says that 40% of everyone who reaches 65 years of age will stay in a nursing home at some point. For all the types of care we have discussed up to this point, skilled nursing stands to benefit the most from any aging demographic. However, no one is going to make bank here. Due to the involvement of Medicare and Medicaid, skilled nursing centers have less pricing power. The heavy reliance on government reimbursement, coupled with questions of how social programs will be funded in the future in context of more old people who will need the money and less young people to foot the bill, means that skilled nursing operators will have to accept whatever money the government decides they are going to give. Some other very illuminating points from the Morningstar article:

– upon admittance to a nursing home is 79.

– of people who entered a nursing home die within one year of admission.

– for patients who eventually died in the nursing home was only five months.

We can reasonably conclude that turnover in skilled nursing facilities is very high. This can lead to lumpy revenue streams that are very hard to predict. With high overhead and fixed costs, if beds aren’t constantly occupied then facilities will struggle.

This reasoning is born out in available data. This graph from The National Investment Center for Senior Housing and Care (“NIC”) shows significant occupancy swings from quarter to quarter:

Source:

Apart from the quarter to quarter swings, there has obviously been a severe downward plunge since 2011, in spite of all those baby boomers getting older. At least part of this can be attributed to the decreased need for skilled nursing centers as technology improves with the tandem rise of outpatient medical care. Due to improvements in technology, people simply don’t need to stay in a bed overnight as much as they used to, or be put up in a skilled nursing center. tells of how the University of Pittsburg Medical Center eliminated 410 beds in 2014 or 8.5% of its capacity due to decreased demand. The article explains:

UPMC is replacing beds formerly used in its medical-surgical, psychiatric and skilled-nursing units with outpatient services.

Favorable demographics won’t reverse the trend, consultants and health system executives say. Weak admissions are projected to last for years despite the millions of newly insured Americans, the aging of the baby boom generation and the steady upward creep of the overall population. “This flat or declining volume for inpatient is not a blip on the radar screen,” said Karin Henderson, executive director of strategic management for six-hospital Cone Health in Greensboro, N.C.

Outpatient medical care is very much in. Notice in the graph above that in spite of horrible flu seasons in Q4 2016 and 2017, skilled nursing occupancy plunged. Why? Medical office buildings and advances in outpatient care. While skilled nursing occupancy has been improving in the last year, resulting in astounding surges in the stock price of skilled nursing focused REITs like Omega Healthcare, up about 35% in the TTM period, potential investors would be wise to keep the above information in mind as they form their investment theses.

Conclusion

An article from the NIC that tries to project future senior housing needs has a great line in it that we should all consider:

It is important to note that these projections are based solely on demographics and do not consider consumer preferences. This is particularly important because the emerging cohort for seniors housing is the baby boomers and they are known as a generation that does not do things the same way as prior generations.

Have investors really taken this into account, and all its implications?

We will end with where we started, waves. Check out this graph that predicts the trend in the baby boomer population:

Source:

Notice the tail end of the wave? Sure, generation x will be aged by that time and will soak up some of the demand. The oldest of the x’ers will turn 65 in 2030. But how are we to anticipate how they will behave? What is that wave going to look like?

Source: Shutterstock/Cassiede Alain

I am worse than a novice, but I have tried out body-boarding while in Hawaii. I don’t know much about the sport, but I do know that wave selection, timing, and positioning are vital to successfully ride the waves. It’s important to pick the right wave. Some are too small to really give you a ride. As it relates to timing, if you try and catch a wave too early the waves will simply go under you before cresting, providing no-wave face on which to ride. If you are too late in timing it, the wave will smash you into the sea. Beyond these aspects of timing you have to consider other obstacles like rocks beneath the surface, weather conditions, or other surfers who might get in your way. Or you might get in their way. That is to say nothing of the occasional shark attack or jellyfish sting (yes, I have been stung by a jellyfish). All this analogizes perfectly with what some are calling “the indisputable demographic wave”. Sure there might be a wave, but how big will it be? How do you know when to time it? How are you going to navigate other investors and institutions who get in your way? What if you choose the wrong level of care to invest in? And what if you choose a REIT that fails to deliver in spite of the wave, and your portfolio gets a bite taken out of it? That sting won’t soon subside.

Though it may seem like it at first glance, this article IS NOT intending to say THERE IS NO WAVE. Rather, I am encouraging caution. This is not a free lunch like many SA authors are making it out to be.

For those that are confident enough to foray into senior housing, I would recommend finding those REITs whose portfolios are concentrated in areas with high senior populations, whose portfolios are triple-net and NOT RIDEA, who have limited exposure to independent living, and who have a big chunk of their portfolio made up of Medical Office Buildings. If you know of any such REIT, please let me know.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Recent Comments